Gann Square Of 9 Excel

- Gann Square Of Nine Excel Formula

- Gann Square Of Nine Chart

- Gann Square Of 9 Excel

- Gann Square Of Nine

- Gann Square Of Nine Excel Workbook

#keshavkumar #financialcorridor #gannsquareofnine #wdgannUnder this video you can find the calculation and approach of angle value based gann Square of Nine. @Biplab Gann Square of nine and Price angles are two different strategies – I have explain both the methodologies for the educational purpose you can use either one of them don’t combine both of them - for the beginner I would suggest gann square of nine because it is basically based on support on resistance and they are just numbers – which you have to follow with Stop loss and faith.

One of our goals at Optuma is to make advanced Gann analysis as simple as possible for our clients. As such, we have created a number of tools that can save you hours of research and painstaking manual calculations in your chart analyses. Not only have we taken the old wooden Square of Nine and made it fully interactive and customisable, but we have also developed a number of tools derived from it, such as the Static and Dynamic Square of 9.

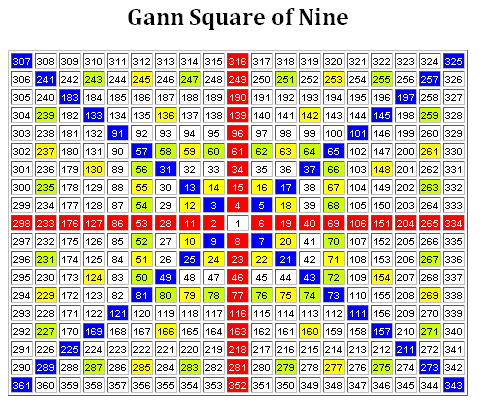

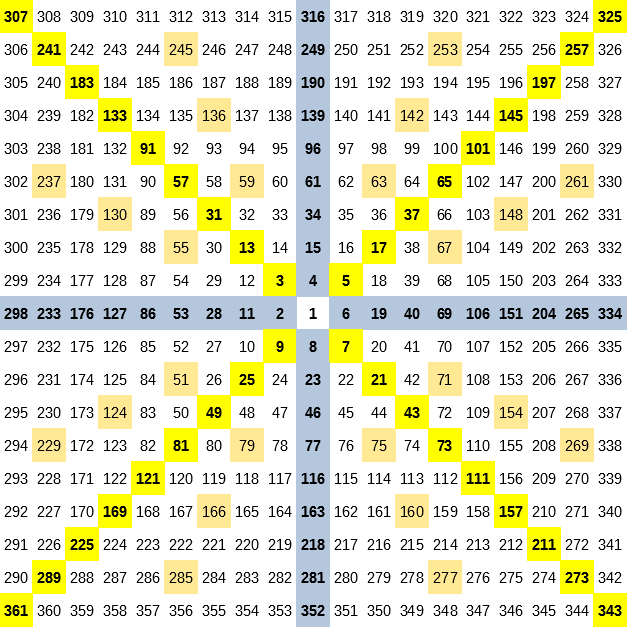

The Static Square of 9 tool calculates price levels according to degree levels – or aspects – of the Square of 9 wheel, starting with 1 in the center. When the Static Square of 9 tool is applied to the chart (with a Price Unit of 1 – more about that later) the first 360 degree level will be 11, the second will be 28, the third 53, etc. Looking at the classic Square of 9 wheel you will see where these numbers appear: all are on the horizontal line to the left of the center value of 1. As each number is one complete revolution around the Square of 9 from the previous number they are said to be 360 degrees apart. Similarly, the 180 degree levels are half way around from the center starting point and directly opposite the 360 degree levels, i.e. 6, 19, 40, etc. Whilst they are 360 degrees apart from each other they are 180 degrees from the center. You will see the relationship between the classic Square of 9 wheel and the levels in the tool in this image:

The Square of 9 chart is also known as a square root calculator: pick a number on the chart, take the square root, add two, and re-square. You will see the value will be the next number around the wheel.

Gann Square Of Nine Excel Formula

Example:

square root of 79 = 8.888

8.888 + 2 = 10.888

10.888 x 10.888 = 118.548

[Note: to calculate 180 degrees around the wheel add 1 to the square root before re-squaring, 90 degrees add 0.5, etc.]

This is why the distance between each successive level is never the same: each subsequent rotation around the wheel is further to travel, so for example, the distance between the 360 degree levels grows wider and wider with each revolution. This is why the distance between the 1st and 2nd 360 degree level is 17 (28 – 11) but from 3rd to 2nd the distance is 25.

Many Gann analysts use the degree levels as potential support and resistance points in the market, and they can work for any instrument in any time frame. The image below shows the Australian Dollar / US Dollar currency pair on a weekly chart, with the Static Square of 9 applied. The degree levels used are semi-square, or every 45 degrees (i.e. 45, 90, 135, 180, 225, 270, 315 and 360 degrees). As you can see, the chart has respected these levels on multiple occasions. In fact, at the time of this writing, the 225 degree level at $0.73 is proving to be a level of support.

Using the Price Unit

One important thing to remember is that the settings for the Square of 9 tool – and all Optuma tools for that matter – can be set by the user to their own specifications, whether the degree levels, the line colours, and perhaps most importantly the Price Unit. This crucial property is found in many Gann tools and it’s important to find the right value for the particular chart being analysed. In the currency chart above for example, using a Price Unit of 1 will not work on a chart trading in the $1 range with small increments. By setting the Price Unit property to 0.01, it recalculates the levels divided by 100, so that the first 360 revolution will be at 0.11 instead of 11, and the 180 degree line mentioned earlier at 1.06 is the equivalent of 106 on the wheel (as seen in Figure 1).

The software will try to select the appropriate price unit by default, but this can be manually adjusted via the tool’s Properties panel.

Gann Square Of Nine Chart

For more information on Price Units, Factors and Harmonics in Gann tools click here.

Going Dynamic

A variation of this tool is the Dynamic Square of 9, which, instead of looking at angles from the center square (ie 1), uses a user-defined value instead. For example, applying the tool on the low of McDonald’s in August 2015 (see chart below) shows the degree levels starting from $87.50, with the first 360 degree level at $128.92 showing resistance, and the current all-time of $178.70 being only a few cents above the second 360 revolution around the wheel from 87.5.

One other important feature of the dynamic tool is that it also works from a high going in the opposite direction, predicting potential support levels or targets. If you apply the tool to a significant high then click a second time below the level of the first click it will calculate the descending levels. The next example shows the high of Tesla at $389 with the Dynamic Square of 9 tool calculating significant support and resistance levels at descending 90 degree increments. By looking at the Square of 9 wheel you will see that the major low at $247 is exactly two 360 degree revolutions inside 389.

Gann Square Of 9 Excel

These are just a couple of examples of some of the advanced Gann tools that we have developed over the past 20 years which, when used in conjunction with other confirmation signals and a robust trading plan, will save you time and improve your analyses. To arrange a free trial of these tools and many more please click here, or click here to contact us.

Darren Hawkins, MSTA

Senior Software Specialist at Optuma

Darren is the senior Software Specialist at Optuma. He joined the company in 2009 after attending an introductory technical analysis course. Darren now instructs users all over the world, from experienced Wall Street traders and professional money managers to individual traders drawing their first trendlines.

Gann Square Of Nine

Darren grew up in the UK and attended college in the USA where he earned a BA in Economics from St Mary's College of Maryland. He went on to spend a few years working at the Nasdaq Stock Market in Washington DC. Going on to live and work in Australia, UK and currently USA, Darren has a broad understanding of the individual needs of traders and investors utilising a wide range of methodologies.

In 2014 Darren passed the UK-based Society of Technical Analysts diploma course, and is looking forward to soon becoming a candidate for the Market Technicians Association's CMT programme.

Gann Square Of Nine Excel Workbook

When not looking at charts, Darren keeps a keen eye on England's cricket team - especially if they are playing against Australia. He recently moved to Charlotte, North Carolina with wife Wendy and their labrador, Gabba.